25+ Online pension calculator

As Veterans and survivors consider applying for Pension benefits VA would like to share important information about the Pension program. Roughly speaking by saving 10 starting at age 25 a 1 million nest egg by the time of retirement is possible.

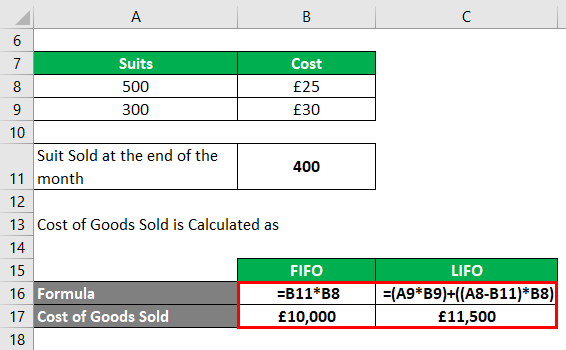

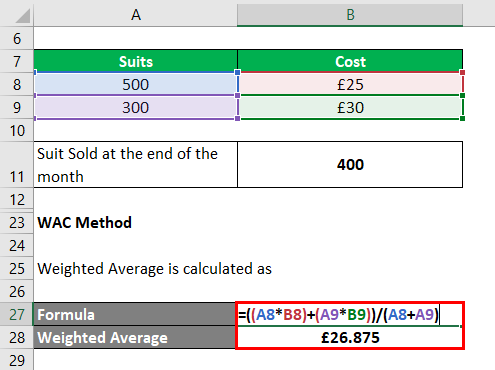

Inventory Valuation Methods Types Advantages And Disadvantages

An additional annuity of 1 will be offered for policies purchased online.

. Call For NRI customers All Days. Usually up to 25 can be paid to you as a tax-free lump sum and the rest stays invested as you choose. Tell us how much tax-free and taxable cash you would like to take.

Watch the ServicetoCivvy short video optional. For Online Policy Purchase New and Ongoing Applications Call All Days from 9 am to 9 pm Toll free 1800-266-9777. National Pension Scheme NPS which is regulated and administered by the Pension Fund Regulatory and Development AuthorityPFRDA is a reliable government-backed plan.

It has made the process more seamless time-saving and easy. Click on and read the Terms. By design the Canada Pension Plan is intended to provide you with approximately 25 per cent of your retirement income.

Pension Drawdown results are available on our calculator for ages 55-74. Pension pot calculator - see how much you need to save for retirement. If you have reached age 75 and have insufficient lifetime allowance this percentage will be lower.

By Richard Browning For Thisismoneycouk. How much can you claim. HDFC Life Guaranteed Pension Plan policy in India offers wide range of annuity options provides a regular guaranteed income for lifetime.

Learn how the VA Pension Program can help you. 6 Winner Life Insurance - Retirement Pension Plans Category. LIC New Jeevan Nidhi Plan.

The annual income based on you taking 35 of your remaining pension pot in drawdown. But with the introduction of eNPS opening an online NPS account takes no more than 30 minutes. Lic Money Back 20 years Maturity Calculator.

On the other hand if you received that enhanced EPS pension the 8 inflation you can change it as desired in the calculator will reduce the purchasing power of this pension by 50 in 83 years. Under current legislation you can take up to 25 of your pension tax-free as a lump sum or in portions. When you earn more than 50000 per year you can claim an additional tax relief either an extra 20 for higher rate taxpayers or 25 for additional rate taxpayers to be paid into your pension pot.

The amount remaining in your pension pot after taking the lump sum. LIC Jeevan Akshay VI Plan 810. VAs pension program provides monthly benefit payments to certain wartime Veterans with financial need and their survivors.

In the US while pensions 401ks and IRAs are great ways to save for retirement due to their tax. If youre currently 55 or over you can choose to access your pension using drawdown. NPS Loyalty and Online discount cannot be taken together.

The calculations assume that 25 of any lump sum from a non-drawdown pension is available tax free. 125 225 or 325 you can see how your pension might grow in the future if earnings growth exceeds price inflation by the given amounts for each year you remain in. Slashing the lifetime allowance from just under 11m to 800-900k a massive cut in pension top-ups for higher earners and new taxes on employer contributions are reportedly being mulled.

Check the calculations to see how much tax youll pay and the. Request call back Missed Call 9606112099. Once you enter your age and pension pot amount well show.

The amount you could take for your 25 tax-free lump sum. As a basic rate taxpayer your pension provider will claim the 20 for you and pay it into your pension pot. For calculations with the CPP enhancements included the CPP Calculator will provide the same result as if you hired Doug to make the calculations.

You can now buy the Indian flag from an authentic government marketplace at just Rs 25. 0759 EDT 21 March 2018. Survey of 2250 people by NielsenIQ across categories.

1222 EDT 25 June 2008 Updated. If youre using a Legal General Aegon Aon PensionBee Prudential ReAssure or Sun Life Financial of Canada pension pot to fund your retirement plan you can call us free to get a Pension Annuity quote for a smaller amount Legal General. The duration for the enhanced withdrawal is almost the same as the duration over which the constant pension drops in value by 50.

For more information about or to do calculations involving pensions please visit the Pension Calculator. Pension Drawdown Calculator Start planning your pension withdrawals with our drawdown calculator. Why you must calculate your CPP benefits CPP benefits are taxable income.

LIC Maturity Calculator calculates the maturity amount based on sum assured bonusFABCalculate premium using Lic maturity calculator for jeevan anand 815. Lic Money Back 25 years Maturity calculator. As the government announced the Har Ghar Tiranga under the aegis of the Azadi Ka Amrit Mahotsav in a bid to encourage people to bring the Tiranga home and hoist it to mark Indias 75th year of Independence.

G262651mmi039 Jpg

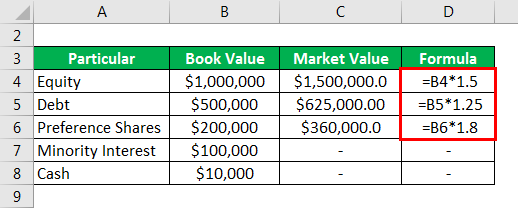

Enterprise Value Explanation Example With Excel Template

Valuation Ratios Springerlink

The Mesmerizing Ad Rate Sheet Template With Rate Card Template Word Digital Imagery Below Is Segment Of Rate Ca Card Template Business Plan Template Templates

G262651mmi021 Gif

How To Make Financial Projections For The Next Five Years For My Startup Quora

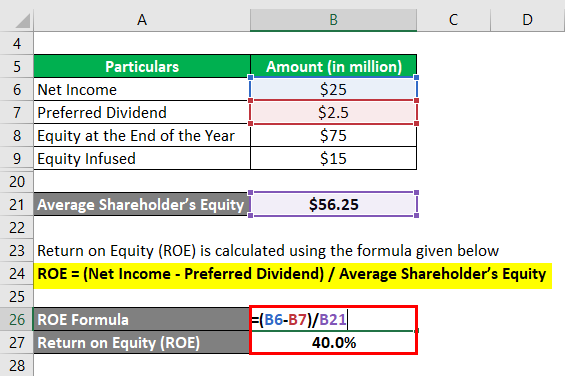

Return On Equity Examples Advantages And Limitations Of Roe

The Stock Market Template Powerpoint

Inventory Valuation Methods Types Advantages And Disadvantages

2

Valuation Ratios Springerlink

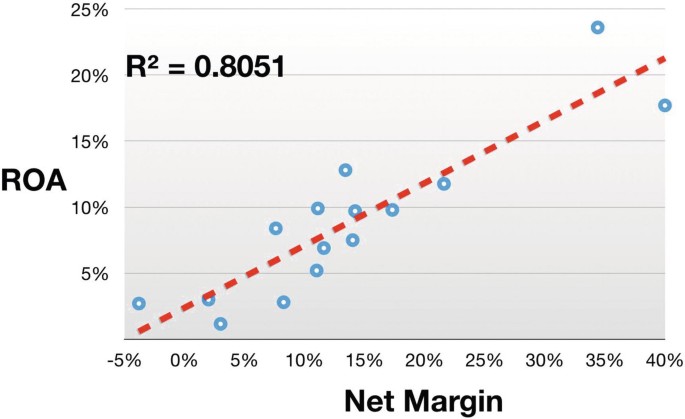

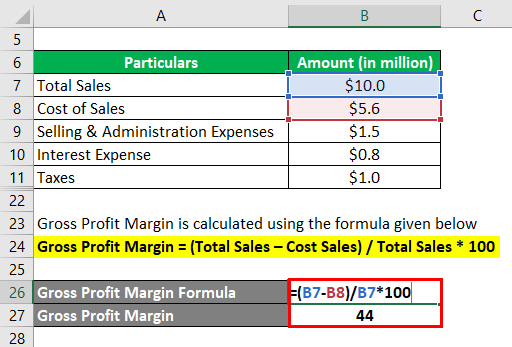

Profit Margin L Most Important Metric For Financial Analysis

Anesthesia Archives The Anesthesia Consultant

Inventory Valuation Methods Types Advantages And Disadvantages

Diy Wedding Cocktail Bar Guide How To Wedding Forward Wedding Cocktail Bar Wedding Alcohol Calculator Wedding Alcohol

Labour Market Analysis Report From The Learning And Work Institute Dmh Associates

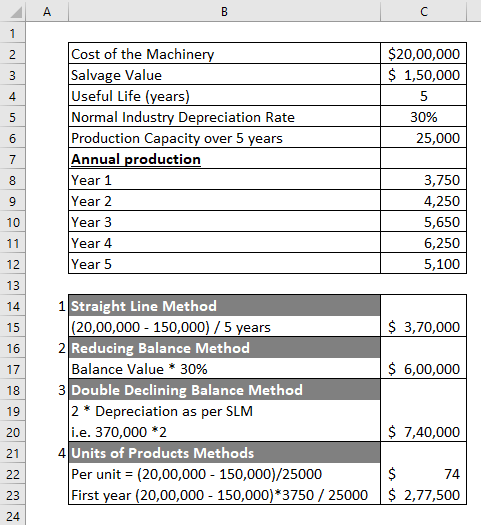

Depreciation A Complete Guide On Depreciation With Explanation